Best Financial Thrillers (Fiction and Non-Fiction)

Financial thriller novels occupy a small sliver of the thriller novel genre. For those inclined to the cerebral thrill of money earned, lost or stolen (whether physically, digitally… or both), there are simply not enough financial thrillers to go around. As a raving fan of the genre myself, I thought it would be helpful to compile a list of some of the best financial thriller novels out there. While the following books’ position on the list below represent my personal opinion, you can rest assured that reading every single one of these novels would make for a year—or few weeks—of excellent entertainment.

Fiction:

The Bonfire Of The Vanities by Tom Wolfe

The original Wall Street novel that introduced the world at large to the “Masters of the Universe” ethos, no list of financial thrillers would be complete without Tom Wolfe’s Bonfire of the Vanities. Sherman McCoy is a multi-millionaire bond trader in New York who hits an innocent person with his car—fatally—and then tries to cover it all up. Beyond the trials and tribulations of McCoy’s downfall, the book perfectly encapsulates many dynamics of the 1980’s, from the rowdy Wall Street trading floors to the decadent parties to the class-based and racial divides of the time.

Reminiscences of a Stock Operator by Edwin Lefevre

Can you believe that this book was written in 1923? Although almost a century old, Reminiscences of a Stock Operator is a must-read financial thriller for any true finance buff. Although technically a piece of fiction, the book is also a biographical story about the early life of infamous trader Jesse Livermore. Although the technical techniques of trading described in the novel have changed completely, what this book excels at is establishing and analyzing the psychological hurdles that one must battle against while trading stocks. Replace a stock trading arcade with an online brokerage and there is very little difference between 1923 and now.

Replay by Ken Grimwood

If you could repeat your life, what would you do the second time? Easy: Make money. While not strictly a financial thriller, Replay by Ken Grimwood contains a long and fascinating story thread that relates to betting and investing—while knowing the outcome ahead of time. The overall concept of this phenomenal book is about a man who randomly wakes up back in time, in college, before he’s even met his wife. He gets to make every decision that he made in his previous life over again, with the added benefit of knowing everything that will happen in the future (up until the date that he “replayed.”)

Flash Crash by Denison Hatch

What would happen if a hacker wrote an algorithm that could crash the stock market? Written by yours truly, Flash Crash delves deeply into modern reality of trading—with super computers and programmers fighting each other for supremacy at lightning-fast speed. Flash Crash also bridges the world between the digital and physical, as the intentional stock market heist quickly turns into a real world gold theft. The NYPD is struggling to figure out exactly what has happened and who’s ultimately responsible while the bad guys fight amongst each other for a piece of the spoils. I happily place this novel on the list because BestThrillers.com called it “One of the year’s best thrillers!” Hey, I’ll take it!

The Penny Thief by Christophe Paul

The Penny Thief is a very interesting and compelling financial thriller that plays into the systemic nature of the modern banking world—and reflects the type of sophisticated financial frauds that are most likely occurring as we speak. One banker discovers that another trader has been stealing small portions of accounts, one cent at a time, for twenty years. Since the money is untraceable, the two men find themselves (and one of their wives) locked into a battle for a secret fortune. I must mention that the novel also has a fantastic cover image.

Data Jack

by Christopher Greyson

Data Jack is one of the first modern techno thriller/ financial thriller novels that I read on the Kindle and I highly recommend it for pure, raw entertainment value. Detective Jack Stratton discovers that data is more valuable than gold when he goes up against a ruthless CEO whose program is designed to steal millions of dollars from the world financial markets.

The Millionaires

by Brad Meltzer

A massive financial crime is the setup for this excellent thriller by Brad Meltzer. What would you do if there was three million dollars sitting in a bank account—and you knew that no one would claim it? This is the question that opens up The Millionaires. But as with all easy money, this money does not come without strings attached…

Non-Fiction:

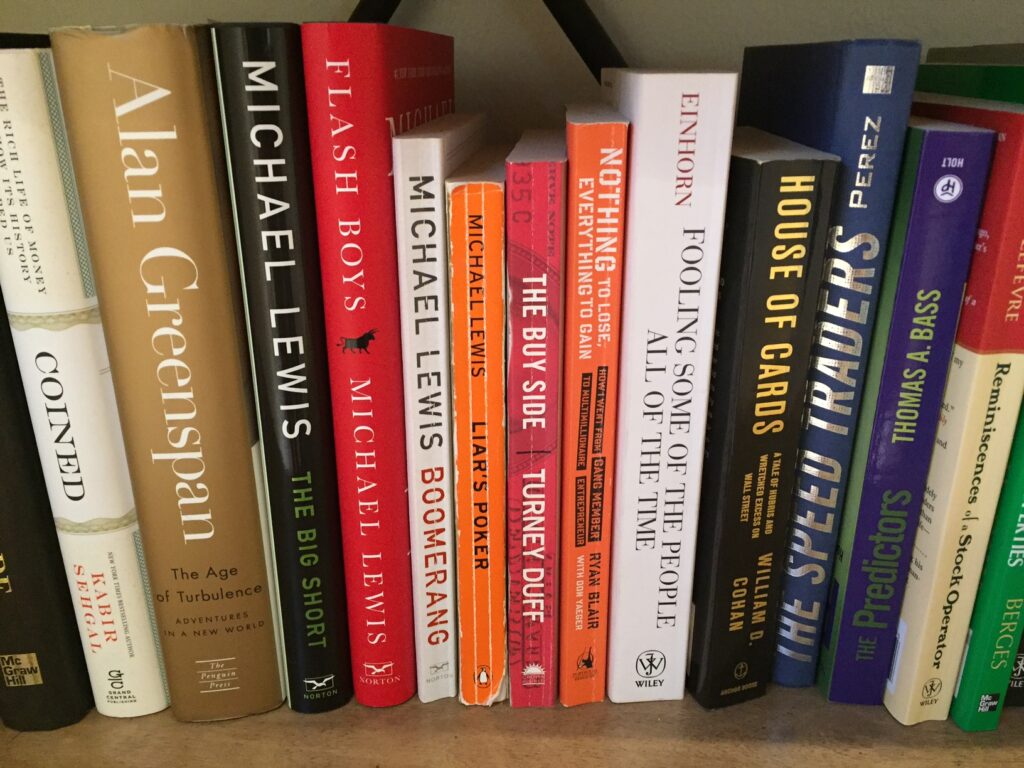

Although I intended to focus primarily on fiction for this list, a few more finance novels stood out to me while I was perusing through my bookshelf. For real:

The Big Short, Liar’s Poker, House of Cards and Reminiscences (amongst others)…

Anyway, I feel that I would be remiss if I didn’t mention them:

Liar’s Poker and The Big Short by Michael Lewis

These two books by esteemed author Michael Lewis (Moneyball) truly act as financial industry bookends. Liar’s Poker represents the hope and fun of the beginning of the Wall Street dream. I doubt that there are many traders on Wall Street who have never read Liar’s Poker. And I know for a fact that many who did read Liar’s Poker were thus inspired to attempt their hand at a trading career. It is a tale of hubris and risk-taking as a new form of financial engineering, securitization, rolled through the industry like a tidal wave. Lewis does a great job of making what could be considered a boring subject nothing of the sort. On the flipside, The Big Short represents the end of the fever. While the financial industry will continue to exist, The Big Short focuses on the 2007-2008 crash—maintaining interest by focusing on the few maverick investors who made money betting against the market. And yes, most of you are probably aware that this novel was turned into a successful movie.

House of Cards by William Cohan

House of Cards also focuses on the 2007-2008 crash—but in a more sober manner, with a wider historical scope. I highly recommend this book, not only for the small little anecdotes peppered throughout, but also for its full explanation of exactly what caused the Great Recession that followed.

The Buy Side by Turney Duff

Decidedly not tame, Turney Duff’s non-fiction novel about his real life as a sales guy in Manhattan is closer to American Psycho than Liar’s Poker. What separates The Buy Side from others is not anything of particular career-building value, but instead pure debauchery and shock value. It is The Wolf of Wall Street, but set in the early two-thousands instead of the nineties. The book is an exciting ride in the beginning, but watching what happens as Duff goes over the deep end and has to reinvent himself is equally entertaining (and ultimately enlightening).